Estate Planning in the New Year: 5 Documents to Update After Major Life Changes

The start of the year offers an excellent opportunity to review your estate plan, especially if you've recently experienced significant life changes. Events such as marriage, divorce, the birth of a child, or acquiring substantial new assets can all impact your existing documents. Proper estate planning helps ensure your wishes are clear and your loved ones are protected, and residents in New York should be especially vigilant due to local regulations and the unique asset structures common in Brooklyn and New York City.

Below are the five most crucial estate planning documents you should review and update following life's major milestones.

1. Will

Your will serves as the cornerstone of your estate plan. It details how your assets should be distributed and who should care for minor children.

Following changes like a new marriage, divorce, or the arrival of a child, it is imperative to review and update your will to:

- Reflect current family members and relationships.

- Change or add guardians for minor children.

- Amend asset distributions, especially if your financial landscape has shifted, which frequently happens in New York's fast-paced real estate environment.

2. Trusts

Whether you have a revocable living trust or an irrevocable trust, these legal tools can provide privacy, avoid probate, and manage legacy assets efficiently.

Major life changes warrant a review of your trust for reasons such as:

- Adding or removing beneficiaries after birth or divorce.

- Modifying asset allocations due to property acquisitions or financial changes, such as a new business venture in Brooklyn.

- Appointing new trustees if former ones are no longer appropriate due to changed relationships.

3. Beneficiary Designations

Many assets transfer outside of probate through direct beneficiary designations, including retirement accounts, life insurance policies, and payable-on-death bank accounts. Marriage, divorce, or the death of a previous beneficiary should prompt you to:

- Update account records to avoid accidental disinheritance.

- Ensure that loved ones are accurately reflected and protected.

- Revisit designations especially after moving or acquiring new accounts within New York's varied financial institutions.

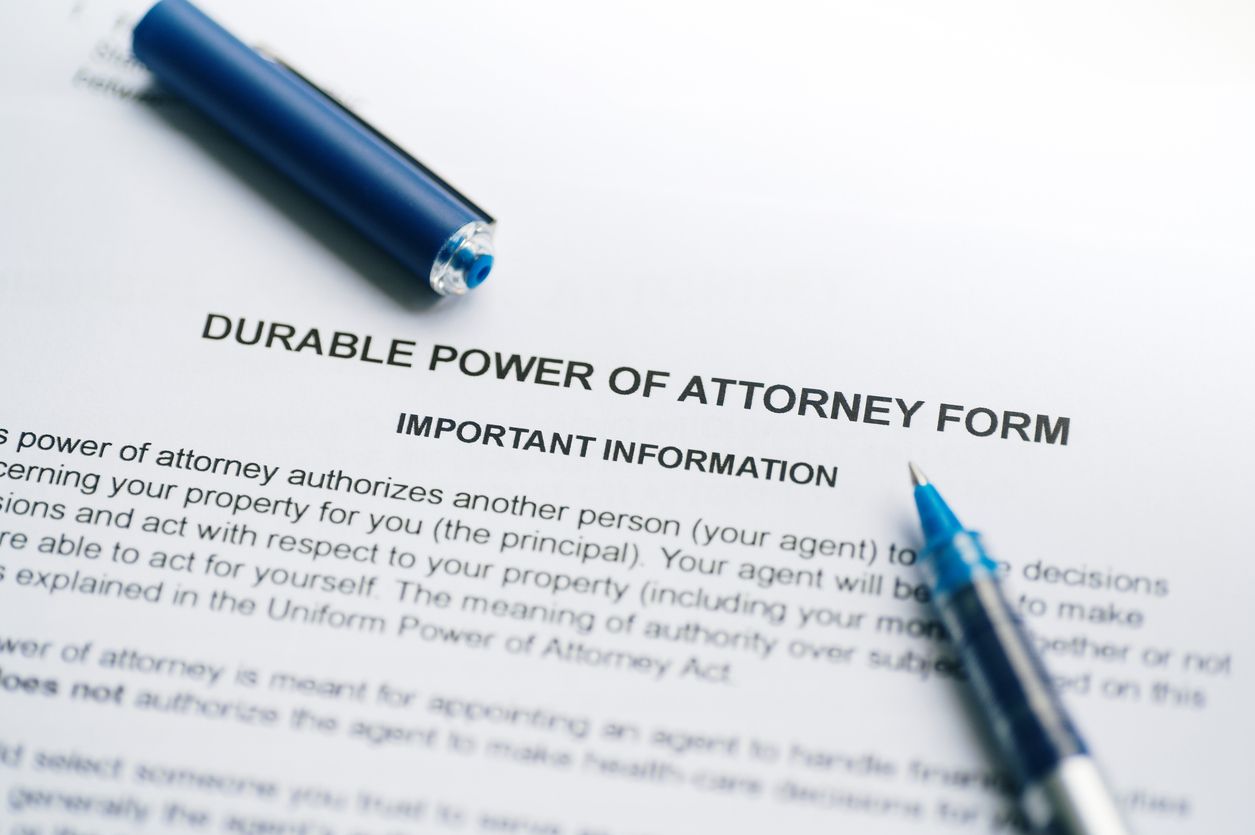

4. Powers of Attorney

A durable power of attorney allows a trusted individual to handle your financial and legal affairs if you become incapacitated. Any shift in your personal relationships or the trustworthiness of your appointed agent is cause to:

- Designate a new agent if your previous choice is no longer appropriate.

- Ensure your agent remains geographically available, which matters if you relocate within or outside New York City.

- Expand or limit powers as your personal and business interests evolve.

5. Medical Directives

Health care proxies and living wills outline your medical preferences and designate someone to make critical decisions on your behalf. These documents are essential for safeguarding your wishes in the event of incapacity. Adjust these documents to:

- Reflect new spouses or trusted loved ones who should now make decisions.

- Express any updated healthcare wishes as influenced by recent experiences or diagnoses.

- Stay compliant with New York medical directive requirements, which are specific and require particular language.

Schedule Your Estate Plan Review with Khalifeh & Strupinsky, P.C. in Brooklyn and New York, NY

Timely estate plan updates after life changes are key for peace of mind and legal protection. If you reside in Brooklyn or anywhere in New York, Khalifeh & Strupinsky, P.C. is prepared to support you with comprehensive estate planning services, trust and probate administration, and asset protection planning. To schedule a confidential consultation, call 917-717-5007 or fill out the firm's secure online form today.